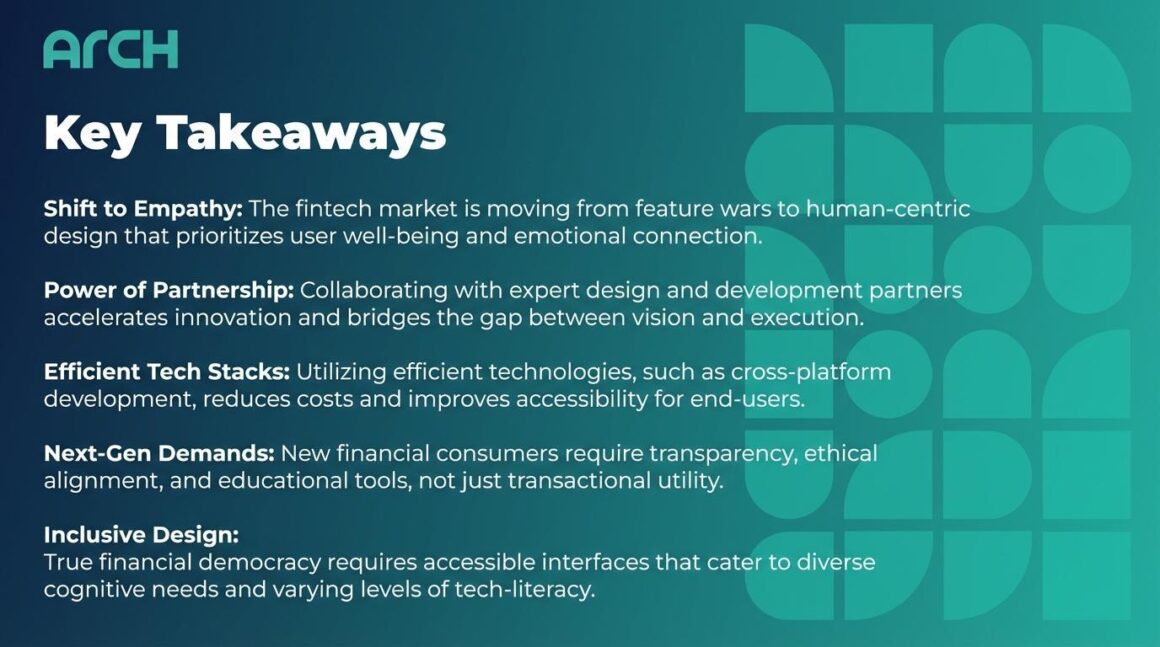

Key Takeaways

Shift to Empathy: The fintech market is moving from feature wars to human-centric design that prioritizes user well-being and emotional connection.

Power of Partnership: Collaborating with expert design and development partners accelerates innovation and bridges the gap between vision and execution.

Efficient Tech Stacks: Utilizing efficient technologies, such as cross-platform development, reduces costs and improves accessibility for end-users.

Next-Gen Demands: New financial consumers require transparency, ethical alignment, and educational tools, not just transactional utility.

Inclusive Design: True financial democracy requires accessible interfaces that cater to diverse cognitive needs and varying levels of tech-literacy.

The Evolution Beyond Features

The fintech landscape has spent the last decade obsessed with disruption. We have seen a race to unbundle banking, optimize algorithms, and gamify trading. However, a significant shift is currently underway. The focus is moving from purely technological capability to genuine human impact.

For the next generation of users, a slick interface is no longer a differentiator; it is the baseline expectation. The true competitive advantage now lies in “human-centric” design. This approach prioritizes emotional connection, financial wellness, and accessibility over feature bloat.

To achieve this, forward-thinking companies are realizing they cannot operate in silos. The complexity of modern financial ecosystems requires a collaborative approach. This is where expert partnerships become the catalyst for true innovation.

Why Impact-Driven Fintech Needs Collaboration

Building a financial product that genuinely serves the underbanked or the digitally native Gen Z requires deep empathy. It also requires rigorous technical execution. Often, internal teams become too insulated to see the friction points their users face.

Expert partners bring a fresh, objective perspective to the product development lifecycle. They bridge the gap between a founder’s ambitious vision and the technical reality required to execute it. This collaboration allows internal teams to focus on their core mission—financial inclusion—while partners handle the complexities of scale and user experience.

By outsourcing specific technical challenges to specialists, fintechs can accelerate their time to market. This speed is vital when addressing urgent economic needs. It ensures that solutions reach the people who need them while the technology is still relevant.

Technology as a Vehicle for Inclusion

Democratizing finance means lowering the barriers to entry. This applies not only to the users opening accounts but also to the companies building the tools. If development costs are too high, the end product becomes expensive, excluding the very people it aims to serve.

Efficiency in development is therefore an ethical imperative. To maximize reach and minimize cost, scalable frameworks are essential. For instance, leveraging Flutter app development services – from an experienced developer such as Arch- allows companies to build beautiful, native-quality experiences for both iOS and Android from a single codebase.

This approach significantly reduces development overhead. It frees up resources that can be redirected toward financial literacy education or lowering transaction fees for users. When technology is chosen wisely, it becomes the great equalizer in the financial narrative.

Designing for the Next Generation

The next generation of financial consumers is unlike any before it. They are digital natives, but they are also deeply skeptical of traditional institutions. They demand transparency, ethical practices, and products that adapt to their unique gig-economy lifestyles.

Human-centric fintech responds to this by moving away from transactional relationships. Instead, it fosters partnership-based interactions between the user and the app. These platforms act as coaches rather than just vaults, offering personalized insights that guide users toward stability.

Accessibility plays a massive role here. True democratization means designing for neurodiversity and varying levels of digital literacy. Expert partners often specialize in these nuances, ensuring that “user-centered” means “all users,” not just the tech-savvy few.

Conclusion

The future of finance is not merely digital; it is profoundly human. As we look toward the next horizon of fintech, the winners will not be the companies with the most complex algorithms. They will be the organizations that best understand the hopes, fears, and needs of their users.

Achieving this level of empathy at scale is difficult to do alone. It requires a ecosystem of expert partners, efficient technology, and a relentless commitment to impact. By embracing this collaborative model, we are not just building apps; we are building a more equitable financial future.

About the Author

Hamish Kerry is the Marketing Manager at Arch, where he’s spent the past six years shaping how digital products are positioned, launched, and understood. With over eight years in the tech industry, Hamish brings a deep understanding of accessible design and user-centred development.

Frequently Asked Questions

1. What is human-centric fintech? Human-centric fintech prioritizes the user’s emotional and financial well-being over raw technological capability. It focuses on solving real human problems, improving accessibility, and reducing financial stress through intuitive design and educational tools.

2. Why should fintechs consider outsourcing development? Outsourcing to expert partners allows fintech companies to access specialized skills and accelerate time-to-market. It enables internal teams to focus on strategy and compliance while partners handle complex technical execution and user experience optimization.

3. How does technology choice impact financial inclusion? The right technology stack, such as cross-platform frameworks, can lower development costs and ensure apps work seamlessly on all devices. This efficiency allows companies to offer lower fees and wider access to underserved populations who may rely on older or less expensive hardware.

Sources

McKinsey & Company- The Future of Fintech